Why People Choose Rental Over Buying

2025-10-24

In any kind of business organization, pricing plays a very vital role. The price affects the psychology of the entrepreneur. Many entrepreneurs decide to rent instead of purchasing an asset. There are many factors involved for entrepreneurs choosing Rental over buying. These factors could include Cost, risk, maintenance, expertise in purchasing an asset, and profitability.

Rental behavior is more of a psychological factor as businessmen consider profit over expense. From wealthy entrepreneurs to small entrepreneurs, choosing rental over buying is becoming a topic of discussion and debate, based on the projects.

Many businesses experience uncertain markets, rapid technology development, and fluctuating demand, and renting becomes increasingly attractive.

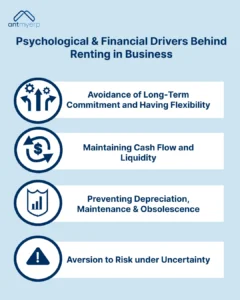

Psychological & Financial Drivers Behind Renting in Business

1. Avoidance of Long‑Term Commitment and Having Flexibility

Companies usually experience fluctuating demand. Projects appear and disappear, and some assets only need to be used seasonally. Purchasing ties up capital, maintenance, and usually depreciating assets. Renting enables companies to reconcile the supply of their equipment/space/assets with demand, minimizing idle equipment.

2. Maintaining Cash Flow and Liquidity

Capital is limited. Companies have to consider opportunity cost: funds spent on acquiring an asset are funds not spent on R&D, advertising, growth, or covering unexpected costs. Renting stretches out costs over time, tending to transform significant capital investments into recurring expenses. This aids in improved cash flow management, less anxiety, and fewer surprises.

3. Preventing Depreciation, Maintenance & Obsolescence

Equipment, cars, and computers depreciate; components fail, and components go out of style. When a company purchases, it has to deal with maintenance, storage, insurance, regulation, and risk of obsolescence. Psychologically, the owner is burdened with ownership expenses, responsibilities, and hassles.

Renting transfers most of these costs (maintenance, renovation, occasionally insurance) to the renting supplier. It reduces worry about whether the property will remain valuable in a decade.

4. Aversion to Risk under Uncertainty

In uncertain economies, boom‑and‑bust cycles, regulatory change, and supply chain uncertainty, risk is a dominant concern. Renting is a less risky approach as there is no risk for the asset to decay over time.

AntMyERP’s rental management software helps to provide real-time data that makes renting easy. The software has built trust in the minds of the users in that rental software helps save capital and increases profitability.

How Rental Pricing Taps into These Psychological Drivers

If you operate a rental company, you can structure price and messaging around these psychological drives. Here’s how:

- Transparent Cost Structures: The company does not have to bear the cost of maintenance, insurance, and other costs. It is the cost for the owner of the asset.

- Flexible Terms & Scalable Rentals: The terms and conditions should be very flexible based on the project requirements. This makes the rental procedure much easier.

- Risk‑Reduced Offers: Warranties, including maintenance, rapid replacements, service level agreements, all reduce the risk.

- Messaging Around Opportunity Cost, Capital Efficiency: Highlight what companies can achieve with capital saved: invest in expansion, marketing, hiring, etc. “Rather than buy, release capital to grow faster.”

- Scarcity & Demand Signals: “Limited units,” “special rates for certain periods,” “best models booked quickly,” such signals create urgency.

AntMyERP is a software that is focused on providing regular updates and the ways to choose the best software. It highlights the importance of saving capital that can be used in different ways.

Real‑World Business Examples

Below are real-life examples where companies preferred to rent instead of buy.

A business, for example, a startup introducing a new product range or growing temporarily, might require high-end laptops, servers, or display monitors for merely a few months. Purchasing such assets could involve substantial initial expense and subsequently idle assets. Several businesses lease IT equipment instead.

This method makes it simple for businesses to scale their resources up or down based on project demands, have a lean cash flow by not being burdened with massive initial expenses, reduce the weight of maintenance obligations, and keep up with fast-changing technology without being left behind with outdated equipment.

Implications for Rental Companies: Pricing & Positioning

If you operate a rental company (equipment rental, asset leasing, etc.), these psychological drivers enable you to maximize:

- Price rental rates so that hiring seems obviously less risky than buying. Add in maintenance, support, and warranty.

- Provide tiered pricing: short-term, long-term, project-based contracts. Give discounts or improved value for longer rental terms so that clients continue to think about the overall cost.

- Give messaging/marketing that highlights cost benefits in cash flow, disaster risk, and obsolescence risk.

- Use anchor pricing (premium version) to make the basic offerings appear cheap.

- Establish credibility: reliability, maintenance, track record. Fear of unexplained breakdowns is a great discourager; if you can eliminate uncertainty, you win.

Conclusion

Companies are opting to rent as compared to buying for reasons not merely of cost, but of fit with psychological safety, financial flexibility, adaptability, and risk avoidance. Freedom from huge upfront capital expenditure, flexibility to move assets with demand, to remain technologically current, and to lighten maintenance and depreciation burdens are strong inducements.

Explore more: Why Smart Businesses Rent Equipment and Why the World’s Smartest CEOs Prefer Renting Over Buying.