MPS Software for MSMEs: How to Get Government Subsidies

2025-08-20

How India’s MSMEs Can Use Government Subsidies for Adopting MPS Software & Digitize Services

“You want to digitize. You want to scale. But your margins say, ‘not yet.’ What if the government could pay for it?”

That’s not a dream. It’s policy.

India’s central and state governments are actively funding digital transformation for small businesses under programs that cover:

- Hardware modernization

- Software adoption (like MPS tools)

- Service automation

- MSME infrastructure improvement

If you run a business with less than ₹250 crore turnover or <300 employees, this blog will show you how to:

- Apply for MSME grants

- Use subsidies to adopt MPS (Managed Print Services)

- Automate field service + RMA + contracts

Let’s break it down step by step.

Government Subsidies for MPS Software and MSME Digitization in India

“Digital transformation of MSMEs is critical to India’s $5 Trillion economy goal.” – Ministry of MSME, India.gov.in

Key Initiatives Supporting You:

Digital MSME Scheme (Ministry of MSME)

- Up to ₹1 lakh subsidy for IT tools/software

- Focus: ERP, CRM, Asset Management, Service Tracking

Credit Linked Capital Subsidy Scheme (CLCSS)

15% capital subsidy for tech upgrades

Startup India plus SIDBI Funding

- Soft loans for tech-first growth

- Linked to equipment rental, field operations, and service industries

MSE CDP (Cluster Development Program)

Grants up to 90% for common digital infrastructure in printing, logistics, education

State Specific Schemes

- Gujarat: Digital MSME Grant

- Maharashtra: IT Infra support

- Karnataka: K-Tech SME Tech Grants

Visit https://msme.gov.in/ or https://udyamregistration.gov.in/ to verify current schemes.

What Expenses Are Eligible Under These Schemes?

- MPS software (like AntMyERP / Rentovi)

- Cloud-based service ticket systems

- Asset tracking (QR code-based)

- Digitization of delivery/RMA workflows

- AMC & contract automation platforms

Hint: Show how your chosen software improves operational efficiency + cost saving.

Why MSMEs Need MPS Software and Service Automation

MPS Reduces Operational Overheads

- Auto toner dispatch

- Cost-per-page billing

- Zero downtime

Field Service Tools Improve Uptime

- Route optimized scheduling

- SLA tracking

- Digital service reports

These capabilities also help businesses improve overall field efficiency by using MPS software to boost technician productivity and reduce repeat service visits.

Service Automation leads to Customer Trust

- Real-time RMA

- Digital contracts

- System led workflows

These categories align with the Digital India MSME vision for Industry 4.0 readiness.

How MSMEs Can Apply for MPS Software Subsidies (Just in 3 Simple Steps)

1. Register on Udyam Portal

You must be a recognized MSME. It’s free and mandatory.

2. Prepare Proposal with Budget Breakdown

Show how the tool (e.g., AntMyERP) will improve efficiency and save cost. Include quotes, projected ROI, and modules.

3. Apply via State/National Nodal Body

Each scheme has its own form and documentation route. Approach your local MSME-DI office or district industries center (DIC).

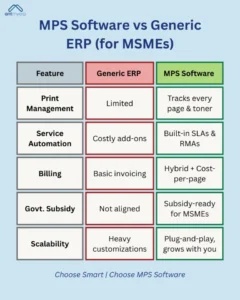

MPS Software vs Generic ERP for MSMEs: What’s the Difference?

Running an MSME means every rupee counts. The software you choose is not just about automation it’s about survival. Many small businesses start with a generic ERP, but when it comes to managing print services, hybrid billing, or government subsidy eligibility, an MPS software is in a league of its own.

Here’s the difference in plain words:

- Print Management: ERPs barely cover it. MPS tracks every page, every toner, and every cost.

- Service Automation: ERPs need costly add-ons. MPS has service workflows, RMAs, and SLAs built in.

- Billing: ERPs stop at basic invoicing. MPS handles hybrid billing, cost per page, and recurring models.

- Government Schemes: ERPs don’t fit. MPS is subsidy ready and designed for MSMEs.

- Scalability & Cost: ERPs demand heavy customizations. MPS is plug and play, built to grow with you.

Generic ERPs are like a thali which is a little bit of everything but never specialized. MPS software is a custom-made meal built exactly for your MSME’s appetite, subsidy ready and cost efficient.

Tip: Choose Software with MSME Pricing + Grant Experience

AntMyERP is designed for:

- Low cost entry for MSMEs

- Modules like MPS, RMA, Field Ops, Contracts

- State-specific onboarding help

- Grant aligned invoice and deployment model

Real Use Case: A Printer Dealer in Gujarat

- Adopted MPS Software with ₹85,000 Digital MSME grant

- Reduced toner waste by 42%

- Added 20 clients in 4 months with auto invoicing

- Government covered 70% of software onboarding and training